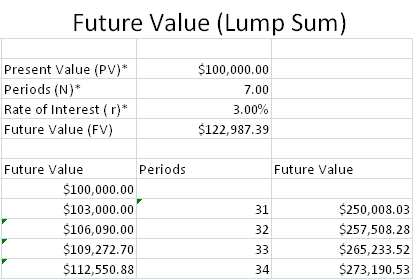

Lump sum future value calculator

The amount of money you have to invest now in order to reach your lump sum goal in time. Human life value Calculator - HLV calculator helps you calculate the life insurance needs and term life cover amount.

Future Value Factors Accountingcoach

Many prospects first gravitate to a fixed rate but find the mandatory lump sum unattractive when compared to the flexibility of a line of credit option or monthly payment plans featured on variable interest rate options.

. Use the interest rate at which the present amount will grow. Lets continue with the example above. For example if you have a 30-year annuity divide by 30 That is the base amount youll receive each year increasing annually by 5 percent The easiest way to look at your total earnings for each year is to use a 30-year lottery annuity payout.

To calculate your lottery annuity you will need to divide your lump sum by the number of payments you will receive. If ACI Benefit paid is equal to the Death Benefit the policy will. Investing a lump sum.

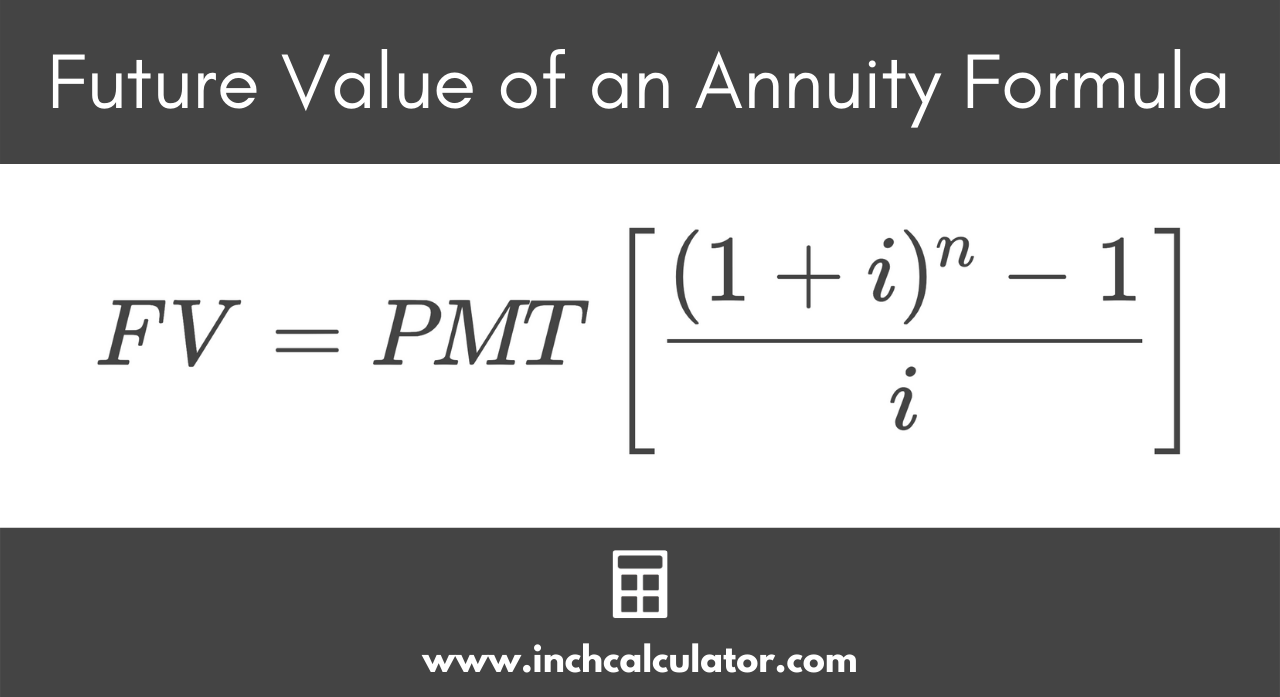

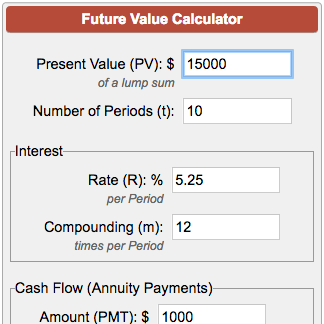

For example if you won the 15 billion Powerball jackpot last year and chose the lump sum payout that would have been a one-time payment of 930 million. Get lump sum on maturity along with protection throughout the policy term. Lets assume we have a series of equal present values that we will call payments PMT and are paid once each period for n periods at a constant interest rate iThe future value calculator will calculate FV of the series of payments 1 through n using formula.

Future Value Annuity Formula Derivation. An annuity is a sum of money paid periodically at regular intervals. Mutual Fund Trailing Returns.

Future cash flows are discounted at the discount. So rather than investing 50 or 100 a month you pay in a lump sum and then leave it there to grow in value. Present Value Formula and Calculator.

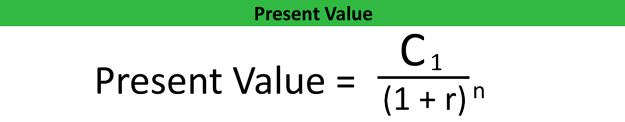

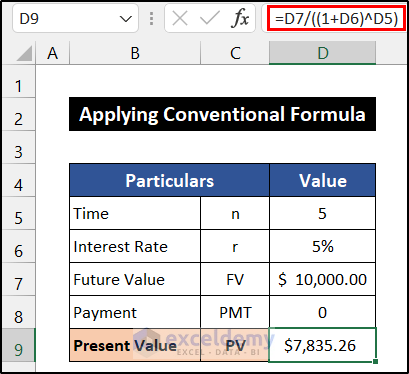

By the way thats a pre-tax. The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. The term lump sum savings is generally used to describe making a one-off payment of a large amount of money into an account or investment fund.

Work out how a lump sum or regular monthly savings would grow. Why FOMO over future higher rates could damage your returns. May 27 2014 Dwaipayan Bose 72500.

This calculator assumes monthly compounding so if you want a different time interval try this compound interest calculatorIf you want to adjust a single lump-sum without compounding try this inflation calculatorOther helpful and related calculators include present value. 11 instead of 11. If you are shopping for the best reverse mortgage interest rate be sure to first compare the programs payment options explained in detail below.

Top Mutual Fund Dividend Plans in the last 5 years. Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Take an honest look at your health and family history of longevity before you make your.

Inflation Calculator Future Value Calculator tells you Future Value of Money based on Inflation Rate. The basic principle of investment says that current purchasing power will have less purchasing power in the future but purchasing power increases with the investment returnsThe future cost calculator uses the below formula to reach a. In other words it calculates what your investment will be worth in real terms net of inflation and taxes.

In the context of pensions the former is sometimes called the commuted value which is the present value of a future series of cash flows required to fulfill a pension obligation. The term lump sum generally means a larger sum of money. The future premiums payable under the policy will reduce proportionately.

Use the Present Value of Cash Flows Calculator to calculate the present value of fixed or changing cash flows to allow insight into future profits based on current costs and known interest rates. Lump sum payouts are usually slapped with hefty taxes so expect your prize to be smaller than what was advertised. Why Should You Avoid a Lump Sum Payout.

Conversely the shorter your life the more valuable the lump sum. First you are expecting a cash flow of 1k per month after 1 year for 6 months or you want to receive a lump sum of 55k now. Value of bond 1000000.

Enter the dollar amount as the future lump sum. Present Value Discount Rate. If your holding period is less than 1 year the gains will be calculated as short-term capital gains and will be taxed at 15 and if the holding period is more than 1 year then long-term capital gains tax of 10 will be levied if.

It does not remain equal within two points of time. Apr 8 2014 Dwaipayan Bose 100809. Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for their day-to-day life after they stop working.

Number of time periods years t which is n in the. The value of currency may fall or rise in the future with respect to the inflation rate. If you take the lump sum the longer you live beyond 20 years the higher your annual return will need to be to match the lifetime income payments.

Input these numbers in the present value calculator for the PV calculation. Present Value of Money. The present value.

Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Lump Sum or SIP. The future value sum FV.

Enter it as a percentage value ie. Because this decision will affect your financial. An annuity provides a lifetime steady stream of income while a lump sum is a one-time payment.

Present Value - PV.

Microsoft Excel Time Value Function Tutorial Lump Sums Tvmcalcs Com

Future Value Of An Investment Calculator Flash Sales 58 Off Www Ingeniovirtual Com

Lottery Winner S Dilemma Lump Sum Or Annuity

Lump Sum Online 53 Off Www Ingeniovirtual Com

How To Calculate Future Value Of A Lump Sum Single Amount Formula With Examples Youtube

How To Use The Excel Fv Function

Fv Function In Excel To Calculate Future Value

Present Value Formula Lump Sum Single Amount Formula With Examples Youtube

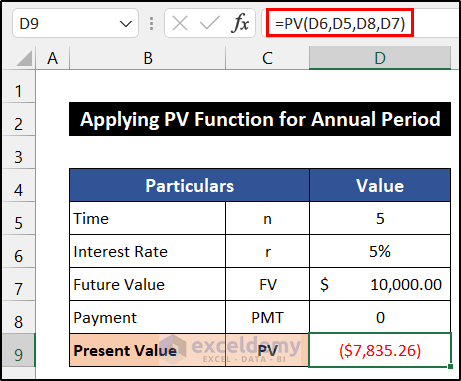

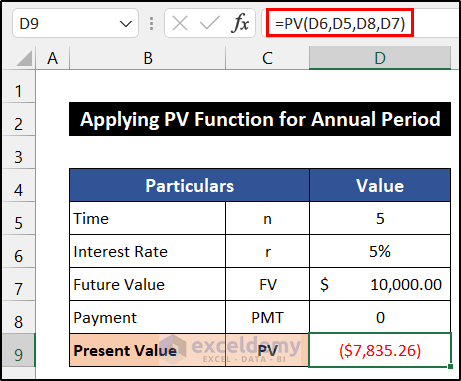

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

Lump Sum Discount Rate Formula Double Entry Bookkeeping

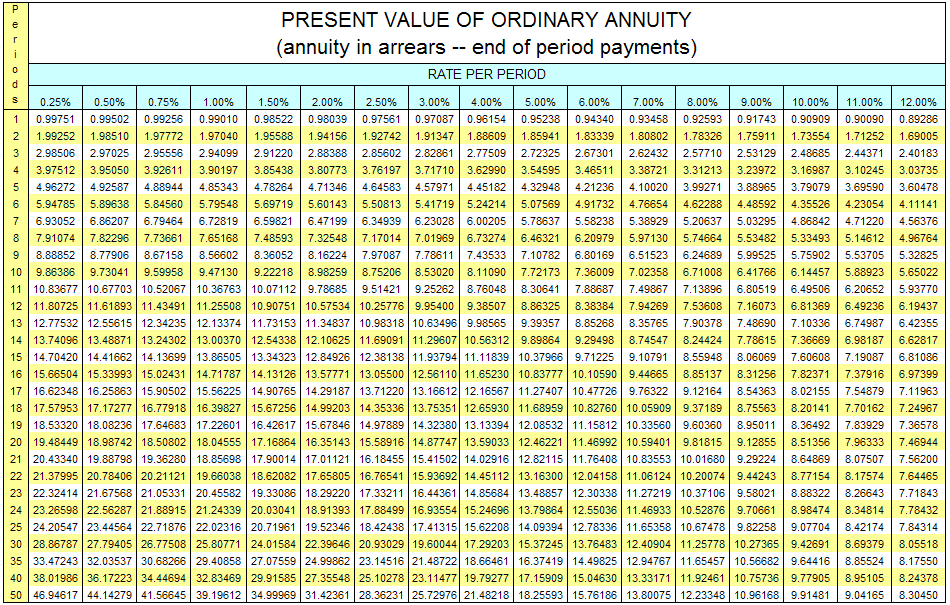

Present Value Formula Calculator Annuity Table Example

Future Value Of An Annuity Calculator Inch Calculator

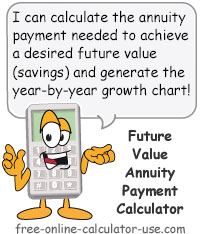

Future Value Annuity Payment Calculator To Achieve Savings Goal

Future Value Of An Investment Calculator Online 59 Off Www Ingeniovirtual Com

How To Calculate The Future Value Of A Lump Sum Investment Episode 38 Youtube

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

Future Value Of A Lump Sum